willqxb9650228

About willqxb9650228

The Rise of IRA Gold Accounts: A Protected Haven for Retirement Financial Savings

In recent years, the monetary panorama has seen a big shift as traders search for more safe options for their retirement savings. One of the most notable tendencies is the rising recognition of Individual Retirement Accounts (IRAs) backed by bodily gold. This article explores the rise of IRA gold accounts, their advantages, potential dangers, and why they are becoming a favored selection for a lot of Individuals looking to safeguard their financial future.

Understanding IRA Gold Accounts

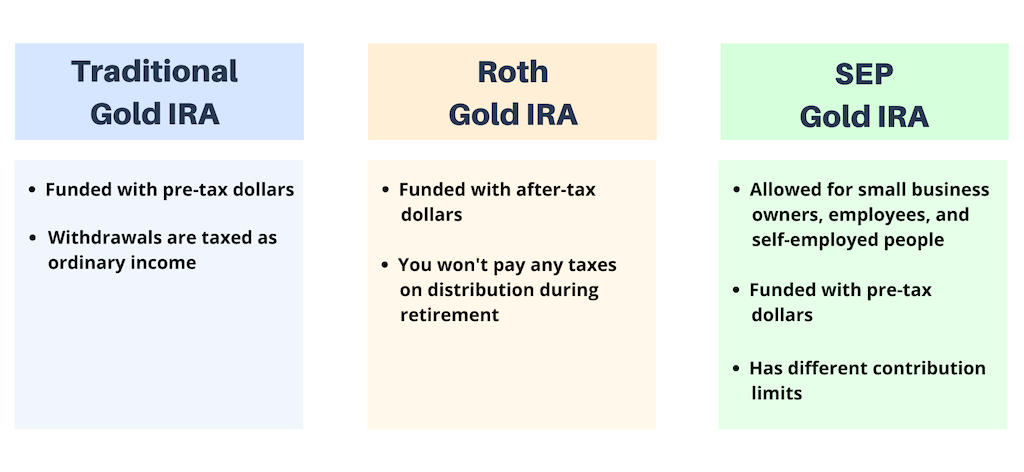

An IRA gold account is a sort of self-directed retirement account that allows investors to hold physical gold and other treasured metals as a part of their retirement portfolio. Not like traditional IRAs, which usually invest in stocks, bonds, or mutual funds, gold IRAs present a novel alternative to diversify and hedge against financial downturns.

The internal Income Service (IRS) permits certain types of valuable metals, together with gold, silver, platinum, and palladium, to be held in these accounts, provided they meet particular purity requirements. For gold, the metallic have to be at the very least 99.5% pure, which implies that only certain coins and bullion bars qualify.

The Enchantment of Gold in Retirement Accounts

The appeal of IRA gold accounts lies in the inherent value and stability of treasured metals, particularly gold. Historically, gold has been seen as a safe haven asset, notably throughout occasions of financial uncertainty. As inflation rises and market volatility increases, many investors flip to gold as a way to preserve wealth.

- Inflation Hedge: One in every of the primary causes buyers choose gold is its potential to act as a hedge in opposition to inflation. When the worth of paper currency declines, the price of gold tends to rise. This inverse relationship provides a layer of safety for retirement savings.

- Diversification: Financial advisors usually advocate diversification as a key strategy for reducing threat in funding portfolios. By including gold in an IRA, investors can stability their exposure to traditional belongings, potentially mitigating losses during market downturns.

- Tangible Asset: In contrast to stocks or bonds, gold is a tangible asset that may be physically held. This physicality can provide a sense of safety for traders who’re wary of the volatility of the inventory market.

- Tax Benefits: Gold IRAs offer the same tax advantages as traditional IRAs. Contributions may be tax-deductible, and the account grows tax-deferred until retirement, allowing for potentially larger accumulation of wealth over time.

Setting up an IRA Gold Account

Establishing an IRA gold account includes a number of steps, and it’s crucial to follow IRS rules to ensure compliance. Here’s a short overview of the process:

- Choose a Custodian: Step one is selecting a custodian that specializes in self-directed IRAs. The custodian will handle the account and guarantee that each one transactions comply with IRS rules.

- Fund the Account: Traders can fund their gold IRA by means of contributions or by rolling over funds from an existing retirement account, resembling a 401(okay) or traditional IRA.

- Select Valuable Metals: As soon as the account is funded, traders can choose which eligible gold and different treasured metals they want to buy. It’s important to work with a reputable supplier to make sure the standard and authenticity of the metals.

- Storage: The IRS requires that physical gold in an IRA be saved in an authorised depository. Investors can not take possession of the metals until they withdraw from the IRA, making certain that the investment stays secure and compliant.

Potential Dangers and Considerations

Whereas IRA gold accounts provide numerous benefits, they aren’t without dangers. Investors ought to carefully consider the next components earlier than committing to this funding strategy:

- Market Volatility: Although gold is often seen as a stable investment, its worth can still be risky. Buyers ought to be ready for fluctuations in worth and perceive that gold costs could be influenced by numerous components, including geopolitical occasions, currency power, and economic indicators.

- Fees and Costs: Organising and sustaining an IRA gold account can contain various charges, including custodian charges, storage charges, and transaction fees. It’s important to understand these costs and issue them into the general investment technique.

- Liquidity: Whereas gold is a liquid asset, promoting physical gold can take time and will involve additional prices. Buyers should consider their liquidity needs and whether they might have to entry funds shortly sooner or later.

- Regulatory Adjustments: The IRS rules surrounding retirement accounts and valuable metals can change. If you liked this article so you would like to get more info pertaining to https://gold-ira.info kindly visit our web site. Traders ought to stay knowledgeable about any potential adjustments that might influence their investment.

The way forward for IRA Gold Accounts

As economic uncertainty continues and inflation remains a concern, the demand for IRA gold accounts is prone to develop. Financial advisors are more and more recommending gold as a part of a diversified retirement technique, and more investors are recognizing the benefits of holding bodily assets of their retirement portfolios.

As well as, the rise of digital platforms and know-how has made it simpler for buyers to entry gold investments and handle their accounts. This accessibility is more likely to further gas interest in IRA gold accounts as a viable option for retirement financial savings.

Conclusion

IRA gold accounts represent an intriguing funding alternative for those looking to diversify their retirement financial savings and protect towards financial volatility. By understanding the advantages, risks, and processes concerned, buyers can make informed decisions about whether to incorporate gold in their retirement technique. As the financial landscape continues to evolve, gold stays a timeless asset that can present security and peace of thoughts for future generations.

No listing found.